The dollar to silver ratio is a crucial metric for investors and analysts in the precious metals market. It indicates how many ounces of silver can be purchased with one U.S. dollar. Understanding this ratio is essential for those looking to invest in silver or gauge the historical performance of silver prices in relation to the dollar. Over the last century, silver has experienced significant fluctuations in price, influenced by various economic factors, market trends, and geopolitical events. This article will explore the dollar to silver ratio, analyze the silver price chart over the past 100 years, and conclude with insights related to daily silver rates.

Dollar to Silver Ratio

The dollar to silver ratio serves as a valuable tool for investors. It reflects the relationship between the U.S. dollar and the silver market, allowing for a deeper understanding of silver’s value. Typically, as the value of the dollar decreases due to inflation or economic instability, the dollar to silver ratio rises, indicating that more dollars are required to purchase the same amount of silver. Conversely, when the dollar strengthens, the ratio tends to decrease.

Historically, the dollar to silver ratio has varied significantly. In the early 20th century, the ratio was much lower, with silver being more highly valued in comparison to the dollar. However, over the decades, as the dollar gained prominence as a reserve currency and economic policies evolved, the ratio saw considerable changes. Investors often monitor this ratio to make informed decisions about buying or selling silver, particularly during times of economic uncertainty.

Silver Price Chart 100 Years

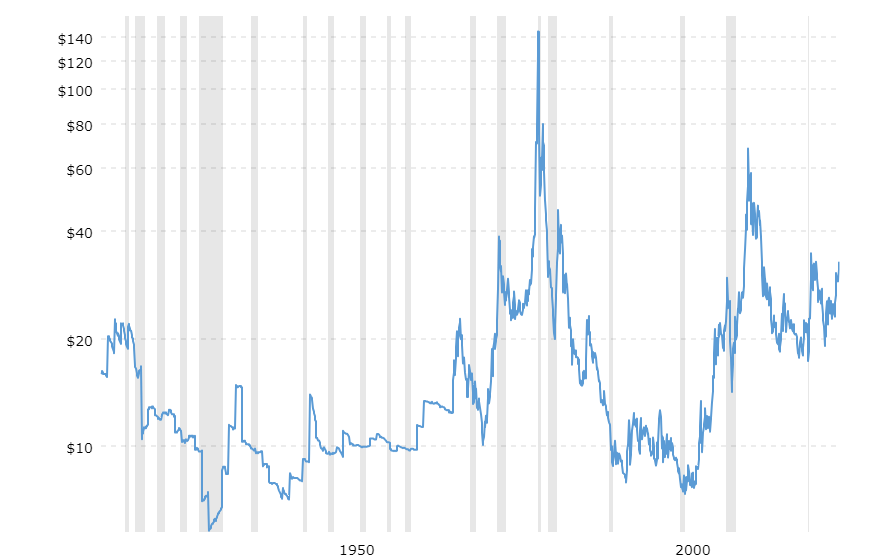

Analyzing the silver price chart over the past 100 years reveals the dynamic nature of the silver market. In the early 1900s, silver prices were relatively stable, but they began to experience volatility during the Great Depression. The price of silver peaked in the 1980s, largely due to speculation and economic factors, before undergoing a prolonged period of decline.

Entering the new millennium, silver prices saw a resurgence, particularly during the 2008 financial crisis, as investors sought safe-haven assets. Since then, the price of silver has continued to fluctuate, influenced by various factors such as industrial demand, inflation, and shifts in investment strategies. The silver price chart illustrates these trends and highlights the periods of growth and decline, providing valuable insights for investors and analysts alike.

Conclusion Related to Daily Silver Rates

In conclusion, the dollar to silver ratio and the historical price chart of silver over the past century offer valuable insights into the precious metals market. For investors, understanding these metrics is crucial for making informed decisions regarding their portfolios. Daily silver rates provide a real-time snapshot of the market, reflecting the current economic landscape. As the world continues to navigate economic changes, the relationship between the dollar and silver will remain a critical consideration for those invested in precious metals. Monitoring the dollar to silver ratio and historical price trends can help investors anticipate market movements and adjust their strategies accordingly.